It’s time companies use their purchasing power to decarbonise the polluting steel industry

Friends of the Earth Finland recently analysed whether companies that buy steel are using their power to encourage decarbonisation of this high-emissions product. Their new Scoreboard shows the companies are doing very little.

Guest Author Vera Kauppinen of Friends of the Earth Finland

Friends of the Earth Finland recently analysed whether companies that buy steel are using their power to encourage decarbonisation of this high-emissions product. Their new Scoreboard shows the companies are doing very little.

Companies are neglecting their supply chain emissions

For most companies, decarbonising the supply chain (upstream Scope 3) has become the priority area of action, dwarfing their own direct emissions. Steel is an input supplied to a myriad of companies, and is a carbon-intensive product (almost 2 tonnes of CO2 per tonne of steel). So by now we might expect steel buyers to be driving decarbonisation in the steel supply chain.

FoE Finland assessed whether 11 companies that buy steel are taking action in essential areas needed for tackling Scope 3 emissions. These companies are major steel procurers operating in Finland across sectors such as machinery, construction, renewable energy, shipbuilding and consumer goods. We asked the following questions:

- Do the companies know their starting point, i.e. disclosing the emissions and other environmental impacts of the steel supply chain?

- Once impact is known, do they set science-based targets to reduce those emissions?

- Are they sending a clear message to the markets and using purchasing power to support decarbonisation in the value chain?

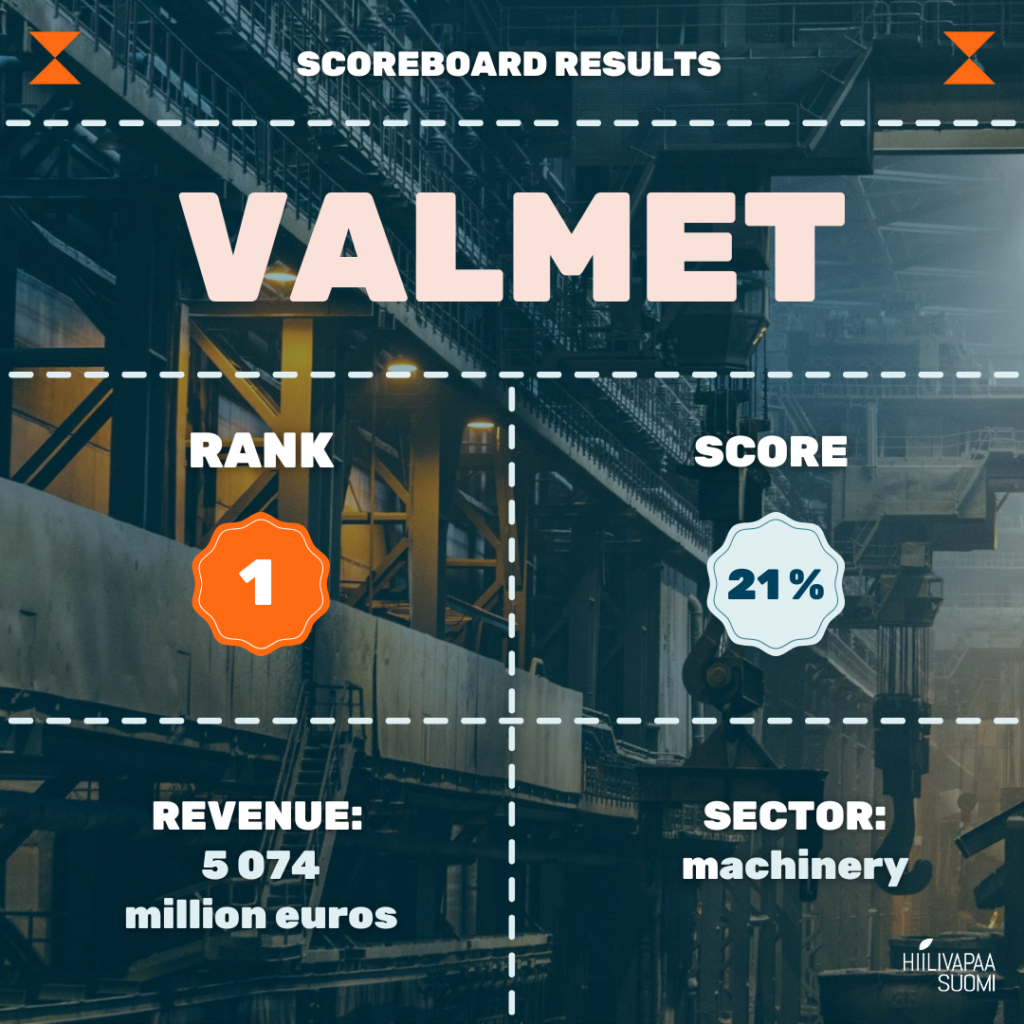

The results, presented in our Scoreboard, leave much room for improvement. The highest score was only 21 out of 100.

Categories for this scoreboard include:

- Disclosure: Most of the companies report only about their own operations and there is a big lack of transparency in their supply chains. Many companies stated they use recycled steel, while some admitted that the current share of recycled steel is very low. However, only two companies explicitly disclosed the share of recycled steel either for their whole production or some product lines.

- Commitments: None of the companies have made commitments to purchase fossil-free steel.

- Incentivising change: Two of the companies are taking smaller steps towards incentivising fossil-free steel production but none are incentivising doing so through stronger supply chain levers such as buyers clubs (e.g. SteelZero) or formal arrangements with steel producers such as offtake agreements, joint ventures or investments in low-CO2 steel.

The lowest scores were due to lack of progress on almost every metric on disclosure, target setting and using supply chain levers. The two lowest scoring companies only specified that they factor in sustainability in addition to cost when choosing a preferred supplier.

The highest score was achieved through good disclosure such as disaggregating Scope 3 emissions and reporting the percentage of recycled steel in production. The highest-scoring company also had SBTi approved targets for value chain emissions, programs in place to monitor suppliers for compliance with GHG emissions targets and incentives for suppliers to reduce emissions.

Although the assessed steel buyers scored quite poorly, some specific good practices can be highlighted. These include:

- developing methods to separate rubber from steel to recycle wearparts,

- offering fully recyclable and long-lasting consumer products made from 90% recycled steel;

- repair services for steel products, and

- looking to replace steel with other materials to reduce emissions.

Everyone must play their part in the decarbonisation of the heavy industries

It is notable that Finland and the Nordics are leading the way to near-zero steel production. The Swedish company SSAB is pioneering fossil-free steel production and Finnish stainless steel producer Outokumpu finding ways to minimise the emission footprint of their scrap-based steel throughout their value chain. However, the steel buyers in Finland have not caught on to the opportunity.

Early movers from the automotive, construction and renewable energy sectors are building a market for near-zero steel. The companies leading in green procurement will benefit in many ways as the regulatory environment gets more stringent and companies face mounting pressure from customers and investors to decarbonise their supply chains. These companies will be able to tap new markets and pass on the costs to their customers, since steel is a raw material whose share of the total product cost is small even when procuring near-zero steel.

However, a handful of first movers will not create a market big enough to unlock the investments needed to get the steel sector on a 1.5 degree aligned pathway. Companies of all sizes need to join the movement and be willing to pay the green premium.

Steel buyers have different options to send a demand signal for near-zero steel.

- Off-take agreements: Large buyers can achieve this through offtake agreements, like in the case of Swedish low-CO2 steel producer startup H2 Green Steel who announced in 2022 that they had signed offtake agreements with buyers for 1.5 million tonnes of their future production.

- Purchasing commitments: Buyers can also make commitments to purchase low-CO2 steel in the future without specifying a particular supplier, but these commitments should include targeted volumes and a timeline. To harness the full potential of such commitments, companies can join buyers clubs such as SteelZero.

- Science-based targets: Committing to decarbonise supply chains and adopting science-based Scope 3 GHG emissions reduction targets only sends an indirect signal and, as such, is the least effective way to encourage near-zero steel production. However, even in this area there were significant gaps in the companies we assessed in our scoreboard.

- Validation: As the demand for low-CO2 steel is on the rise, steel producers have reacted by offering a variety of green steel labelled products. Steel buyers need to make sure that the steel they are procuring is genuinely leading to significantly lower emissions, otherwise there is a risk of greenwashing and emissions accounting tricks without meaningful action in decarbonising the production methods.

The time for a genuine fossil-free steel revolution is now

A steel buying company is in a key position to steer the industry towards a net-zero path and ensure real emissions cuts and reduce their own Scope 3 emissions. The necessary steps are explained further in our recommendations.

The best time to start decarbonising supply chains and supporting steel decarbonisation was yesterday. The next best time is now.